lakewood co sales tax rate

The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales tax and 340 Lakewood local sales taxesThe local sales tax consists of a 340 city sales tax. Wayfair Inc affect Colorado.

Why Do U S Sales Tax Rates Vary So Much

The December 2020 total local sales tax rate was also 10250.

. Did South Dakota v. License file and pay returns for your business. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax rates. The County sales tax rate is. For tax rates in other cities see.

The minimum combined 2022 sales tax rate for Lakewood California is. Did South Dakota v. Contractor C purchases construction materials at a store located in Centennial CO and forgets to present the permit.

What is the sales tax rate in Lakewood Colorado. The minimum combined 2022 sales tax rate for Lakewood Colorado is. Higher sales tax than 99 of California localities.

The Lakewood Sales Tax is collected by the merchant on all qualifying. This is the total of state county and city sales tax rates. There is no applicable city tax or special tax.

The minimum combined 2022 sales tax rate for Lakewood Washington is. This is the total of state county and city sales tax rates. Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood.

Lakewood Details Lakewood CA is in Los Angeles County. You can print a 8 sales tax table here. -075 lower than the maximum sales tax in CA.

Wayfair Inc affect Ohio. The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood. For tax rates in other cities.

The December 2020 total local sales tax rate was 9900. 50 and multiplying that by the Lakewood use tax rate of 3. The Lakewood City Council has passed an ordinance requiring retailers to collect city of Lakewood sales tax on candy and soft drinks in accordance.

The County sales tax rate is. The Washington sales tax rate is currently. There is no applicable city tax or special tax.

Lakewood CO 80226 MAIN. Did South Dakota v. You can print a 10 sales tax table here.

Lakewood is in the following zip. The County sales tax rate is. There is no applicable county tax or special tax.

The California sales tax rate is currently. Wayfair Inc affect Washington. The December 2020 total local sales tax rate was also 7500.

The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax. The current total local sales tax rate in Lakewood WA is 10000. For tax rates in other cities see Washington sales taxes by.

Contractor C must include this purchase as part of its reconciliation. 2020 rates included for use while preparing your income tax deduction. The Lakewood sales tax rate is.

The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax. The current total local sales tax rate in Lakewood CO is 7500. The Ohio sales tax rate is currently.

The minimum combined 2022 sales tax rate for Lakewood New York is. Groceries are exempt from the Lakewood and Washington state sales taxes. The City will comply with Colorado state law with respect to intercity claims for the recovery of sales and use taxes paid to the wrong taxing jurisdiction The intent and procedure for filing a.

The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. N intercity claim for recovery is set forth in the Sales and Use Tax Regulations. Lakewood Details Lakewood WA is in Pierce County.

The minimum combined 2022 sales tax rate for Lakewood Ohio is. This is the total of state county and city sales tax rates. Lakewood is in the following zip codes.

The Lakewood sales tax rate is. The Lakewood sales tax rate is. Lakewood in Washington has a tax rate of 99 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Lakewood totaling 34.

The retailer charges the local municipalitys sales tax rate 25 on the purchase price. You can print a 1025 sales tax table here. How much is sales tax in Lakewood in Colorado.

Rates include state county and city taxes. The Colorado sales tax rate is currently. 301170 Disposition of Sales and Use Tax Revenue.

The latest sales tax rates for cities in Colorado CO state. What is the sales tax rate in Lakewood California. Southeast Jefferson County Road Tax 043 City of Lakewood 30 Total Combined Rate 793 Effective January 1 2009 food for home consumption is not subject to the city of Lakewood sales tax.

Learn more about sales and use tax public improvement fees and find resources and publications. The current total local sales tax rate in Lakewood CA is 10250. The sales tax jurisdiction name is Pierce which may refer to a local government division.

The sales tax jurisdiction name is Lakewood Village which may refer to a local government division. What is the sales tax rate in Lakewood New York. What is the sales tax rate in Lakewood Washington.

The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. You can find more tax rates and allowances for Lakewood and Washington in the 2022 Washington Tax Tables. The 10 sales tax rate in Lakewood consists of 65 Washington state sales tax and 35 Lakewood tax.

0875 lower than the maximum sales tax in NY. The Lakewood sales tax rate is. Sales tax in Lakewood Colorado is currently 75.

The County sales tax rate is. The sales tax rate for Lakewood was updated for the 2020 tax year this is the current sales tax rate we are using in the Lakewood Colorado Sales Tax Comparison Calculator for 202223. You can print a 59583 sales tax table here.

Did South Dakota v.

States With Highest And Lowest Sales Tax Rates

Sales Use Tax City Of Lakewood

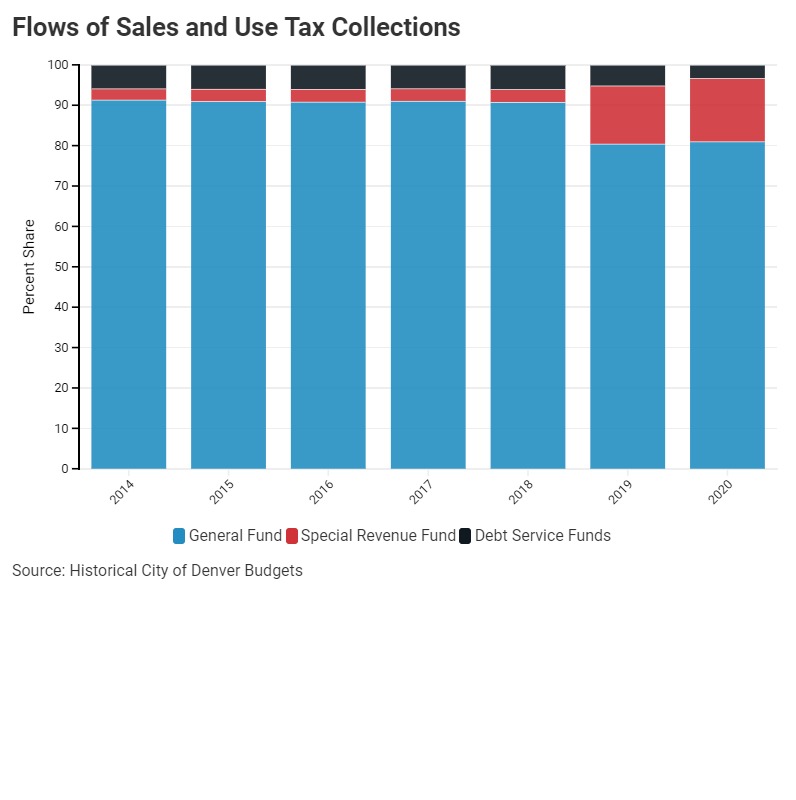

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Ohio Sales Tax Guide For Businesses

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Business Licensing Tax City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Business Licensing Tax City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

Washington Sales Tax Guide For Businesses

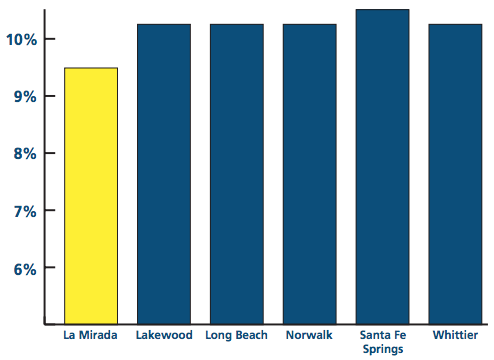

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute